Description 4

At Yinson, compliance and ethical conduct is established at the highest level. Our Code of Conduct and Business Ethics provides guidance for all Yinsonites to perform their jobs with upmost integrity, and forms the basis for building a compliance culture throughout the company in perfect cohesion with our corporate culture and core values, R.O.A.D.S. In line with Yinson's Anti-Bribery and Anti-Corruption ("ABAC") Policy & Procedure, the Group also practices ZERO tolerance for bribery and corruption.

Group Chief Executive Officer, Lim Chern Yuan

Overview

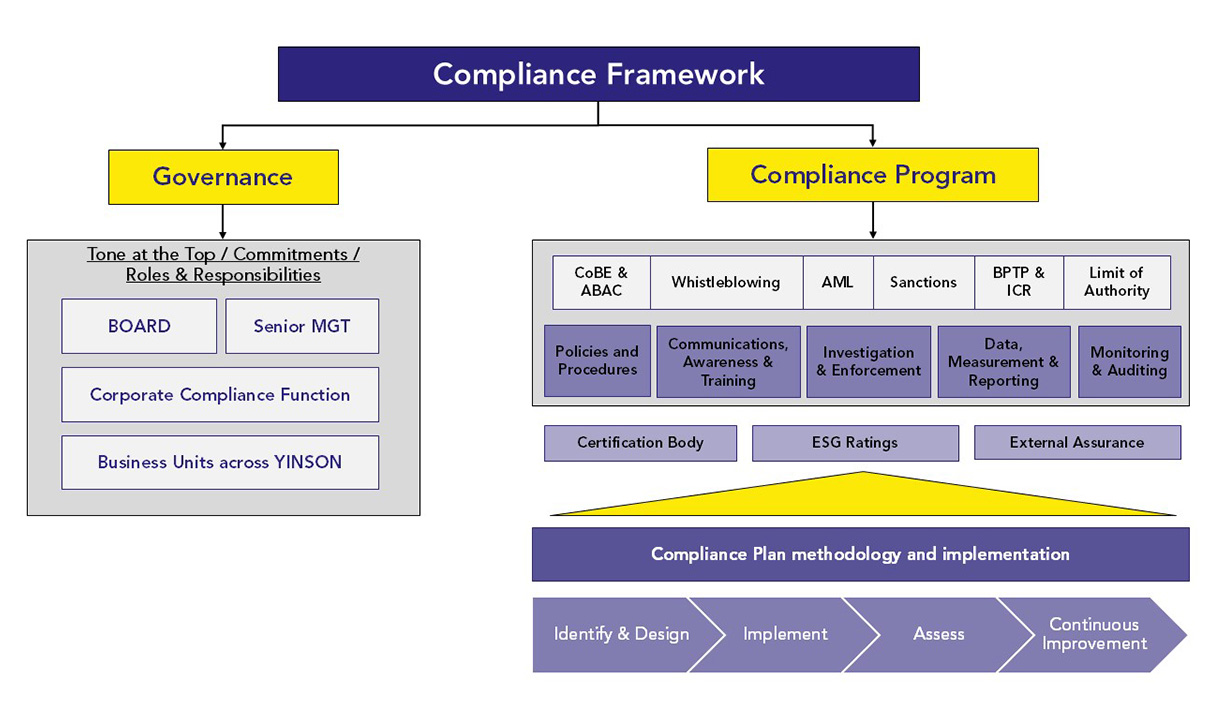

At Yinson, compliance is a system of controls intended to provide a cost-beneficial level of assurance that the Group complies with all applicable laws, regulatory requirements and internal policies. Yinson is committed to conducting our business responsibly, in accordance with the laws of the countries where we operate in. This is guided by our Vision, Mission, Strategies and Compliance Framework.

Institute a strong compliance culture throughout Yinson in building a robust internal control system.

1. Deeper integration of compliance and integrity culture from top to bottom of business process.

2. Proactive and continuous optimization of training and communication.

3. Effective monitoring and reporting system.

How Yinson ensures compliance

-

Yinson employees’ ABAC online training completion rate as of 1st

July 2021 via the newly rolled out Learning Management System in May 2021

At the heart of Compliance in Yinson, is the Code of Conduct and Business Ethics (“COBE”) Policy and Procedure. Other policies and procedures namely Anti-Bribery and Anti-Corruption Policy and Procedure, Anti-Money Laundering Policy, Whistleblowing Policy and Procedure and Human and Labour Rights Policy complements the overall approach for the COBE on how Yinson employees conduct themselves at Yinson.

Compliance Guide for Business Partners, International Commercial Representatives & Third Parties

At Yinson, we expect all Business Partners, International Commercial Representatives and Third Parties to act in a way that is consistent with Yinson’s values and ethical standards. The infographic poster below serves as an overview guide for third parties on Yinson’s practices:

Please refer to our Code of Conduct and Business Ethics Policy and Procedure, Dealing with Third Parties Policy and Procedure, and Dealing with Business Partners and International Commercial Representatives Policy and Procedure for more details.

ISO 37001 Anti-Bribery Management Systems (“ABMS”) Certification

Compliance and ethical conduct are established at the highest level at Yinson. This is evident with Yinson Holdings Berhad and Yinson Production Offshore Pte Ltd Singapore being awarded with the ISO 37001 ABMS certification by Bureau Veritas in October 2021.

Gaining this accreditation means that these entities have exhibited the commitment to an ethical culture in conducting business; demonstrating that our procedures and processes are in line with the ISO 37001 ABMS standard.

Additionally, being accredited enables these entities to promote confidence to both internal and external stakeholders that a robust ABMS is in place and it has been independently assessed.

Anti-Bribery and Anti-Corruption (“ABAC”) Training

We are committed in raising compliance awareness and rolling out compliance-based trainings and communications across the Group.

All employees are required to undergo the ABAC online training module and assessment. The online module ensures that all Yinson employees across our global offices have equal access to the same ABAC training and communications. Refresher courses are held annually and are compulsory for all employees. All employees also need to acknowledge the ABAC Policy & Procedure to pledge their commitment and confirm compliance to the policy.

Emphasis is also made on the interaction with Public Officials or Government where Yinson does not use Yinson's funds or resources to support, contribute or spend for political campaigns, political party candidates, political organizations, lobbyists or lobbying organizations and trade associations.

ABAC Guide, Cautionary Notice & Corruption Perception Index (“CPI”) Index

Yinson's ABAC guide for employees :

Yinson's ABAC cautionary notice card for employees :

- Arabic

- Bahasa Malaysia

- Chinese

- English

- French

- Hindi

- Indonesian

- Italian

- Norwegian

- Portugese

- Spanish

- Tamil

- Vietnamese

CPI Index:

Corruption Perception Index 2023 by Transparency International

Please refer to our Anti-Bribery and Anti-Corruption Policy and Procedure and Anti-Money Laundering Policy for more details.

We are committed to uphold our stakeholders' trust by adhering to the highest ethical standards of business conduct and promoting a culture of transparency, integrity and accountability.

If you know, or are aware of any improper conduct (misconduct or criminal offence) being committed, or is about to be committed within Yinson, you may come forward and express these concerns through proper channels without fear of unfair treatment or reprisal.

You may report anonymously, but it is highly recommended that you provide an email address for you to remain informed on the status of the report.

However, for employees of Yinson, if your report is in relation to employee workplace grievances, please contact your local HR representatives to highlight and address the matter.

We are committed to respect and uphold all internationally-recognised human rights as relevant to our operations.

The Universal Declaration of Human Rights, as well as the eight core conventions set out by the International Labour Organisation’s (“ILO”) Declaration on Fundamental Principles and Rights at Work highlighted elements that include freedom of association, non-discrimination, anti-forced and anti-child labour, among others. In the entirety of Yinson’s sphere of influence, the company seeks to:

a. Protect or maintain all expressed elements of human rights; as well as,

b. Prevent or mitigate activities that may in any way contribute to the infringements of human rights.

Internally, these goals are supported through the establishment of a system of policies and procedures that, among others, include our Code of Conduct and Business Ethics. We remain steadfast in our position and fully expect all external parties whom we have business relations with, including our business partners, suppliers, and any other affiliated entities to abide by the principles set out within the documents mentioned above.

Please refer to our Human and Labour Rights Policy, and Code of Conduct and Business Ethics Policy and Procedure for more details on our stance and approach towards human rights.

In addition, our Norwegian Transparency Act Statement 2023 details the policies and due diligence practices in safeguarding human rights and decent working conditions, in accordance with the Norwegian Transparency Act.

Separately, the Brazilian Labour Authority (Ministério do Trabalho e Emprego) has mandated a disclosure under the Act nº 14.611/23 to ensure gender wage transparency and equality in 2024. Yinson Production Brazil has prepared the disclosures (in Portuguese) in accordance with this Act:

Our Approach to Tax

Yinson’s overall approach to tax management is aligned to our core values and code of conduct, and it is centered on ensuring that we pay our fair share of taxes and effectively contribute to the countries and communities that we operate in.

In line with our tax strategy, we prioritise sustainability and our commitment to Environmental, Social and Governance (“ESG”) requirements at the core of our decision-making framework. This is achieved by aligning our key tax governance and risk management practices, to Yinson’s overarching ESG strategy and objectives.

This tax strategy reviewed by the Audit Committee and approved by the Board of Directors sets out Yinson’s tax strategy and approach, in conducting its tax affairs and dealing with tax compliance obligations for the financial year ended 31 January 2024. There is a periodic review by Group Tax and any amendments will be submitted for approval by the Board of Directors.

It is comprehensively applied across the entire Yinson, and compliance with this tax strategy is monitored systematically and periodically.

This tax strategy has been prepared in line with the key principles of the Global Reporting Initiative 207, the Bursa Tax Governance Guide and Paragraph 19 and Paragraph 20 of Schedule 19 of the United Kingdom Finance Act 2016.

Tax Governance

Yinson views tax as a fundamental part of our corporate responsibility and governance measures. The Board of Directors is responsible for the management of our tax affairs, and this includes monitoring tax compliance and ensuring that there are regular updates based on requirements.

Tax Governance

Yinson views tax as a fundamental part of our corporate responsibility and governance measures. The Board of Directors is responsible for the management of our tax affairs, and this includes monitoring tax compliance and ensuring that there are regular updates based on requirements. Upholding Compliance Requirements

In accordance with our ‘Compliance First’ philosophy, Yinson is committed to paying our fair share of taxes and effectively fulfilling our tax reporting obligations, with the accurate and timely submission of tax returns and other required documents. This includes complying with all the applicable local tax laws and regulations in all countries of operation, in line with the relevant letter and spirit of the law.

Upholding Compliance Requirements

In accordance with our ‘Compliance First’ philosophy, Yinson is committed to paying our fair share of taxes and effectively fulfilling our tax reporting obligations, with the accurate and timely submission of tax returns and other required documents. This includes complying with all the applicable local tax laws and regulations in all countries of operation, in line with the relevant letter and spirit of the law. Business Structure

We are committed in using business structures with genuine substance, that are guided by commercial requirements and are aligned with our business activities.

Business Structure

We are committed in using business structures with genuine substance, that are guided by commercial requirements and are aligned with our business activities. Utilising Tax Incentives

Where available and applicable, Yinson utilises tax incentives, in line with the relevant regulatory frameworks, the intended policy objectives of the Governments that introduced the incentives and the overall business requirements.

Utilising Tax Incentives

Where available and applicable, Yinson utilises tax incentives, in line with the relevant regulatory frameworks, the intended policy objectives of the Governments that introduced the incentives and the overall business requirements. Relationship with Tax Authorities

We seek to have open, collaborative and transparent professional relationships with the Tax Authorities in the countries that we operate in.

Relationship with Tax Authorities

We seek to have open, collaborative and transparent professional relationships with the Tax Authorities in the countries that we operate in. Transparency

We aim to conduct our tax affairs in a transparent manner, with regular updates to our key stakeholders on our approach to tax, tax governance measures and taxes paid in the different countries that we operate in.

Transparency

We aim to conduct our tax affairs in a transparent manner, with regular updates to our key stakeholders on our approach to tax, tax governance measures and taxes paid in the different countries that we operate in.

Yinson’s tax governance is part of the oversight mandate of the Board of Directors, and this includes setting clear responsibilities and mechanisms to ensure timely tax compliance. In accordance with Yinson’s tax governance structure, the Board of Directors is responsible and accountable for the overarching management of our tax affairs and governance measures, and the day-to-day tax operations are delegated and managed accordingly by Group Tax in line with the requirements of Yinson’s tax strategy and policy.

Yinson’s Group Tax will work together with the Group’s business, operations and finance departments, to provide guidance for compliance with the tax regulations, whilst ensuring that business decisions and transactions are commercially sound and effectively considers the key tax implications. The business, operations and finance departments will seek input and guidance from Group Tax on the following:

- Business proposals to ensure a clear understanding of the key tax consequences and implications.

- Assessment and management of tax risks to ensure compliance with local and overseas tax regulations in respect of Yinson’s cross border related party transactions.

- Tax technical position to ensure that the stance taken is supported by appropriate documentation, legal interpretation and taking into account the practice adopted by the Tax authorities. Where required, external tax advice would be sought in consultation with Group Tax.

- Audits and enquiries from Tax/ regulatory authorities.

We employ comprehensive and robust tax governance measures, which effectively considers our tax (which can be defined as the relevant direct taxes, indirect taxes and transactional items) reporting obligations and requirements.

Our Group Tax policy has been implemented and operationalised, in line with our tax risk management measures. This policy has been approved by the Board of Directors, and it outlines Yinson’s key tax processes and the relevant lines of reporting and escalation.

Based on the principles set out above, our approach and attitude to tax planning is outlined as follows:

- We are committed to using business structures with genuine substance, that are guided by commercial requirements and are aligned with our business activities. We do not:

- Use artificially fragmented structures or contracts to avoid establishing a taxable presence in the countries or jurisdictions where we do business.

- Engage in business arrangements which are solely focused on creating a tax benefit, which is not consistent with the ordinary course of the business and what is reasonably understood to be intended by the relevant tax rules.

- We do not partake in abusive tax schemes.

- Our operations and business transactions are guided by our overall business purpose, whilst taking into consideration the relevant tax impact.

- We do not use tax havens for the purposes of obtaining tax benefits, and our current business model and selection of countries of operation are driven by substantive and commercial considerations.

- We pay tax on profits/ income according to where value is created within the course of our commercial activities. Our tax principles extend to our relationships and communications with all employees, customers and contractors.

- The transactions between the companies in the Yinson group are priced in accordance with the arm’s length basis, and reflects the economic reality of the transaction, in line with OECD’s principles and the prescribed transfer pricing rules in the countries we operate in.

- Where available and appropriate, Yinson will utilise tax incentives and reliefs, provided it is supported with genuine commercial activity and aligned with the intended policy objectives of the Governments that introduced the incentives.

As part of our tax risk management, we monitor our transactions to effectively identify potential tax risk, in accordance with changes in the relevant tax laws and practices. This includes identifying and assessing/ categorising potential tax risk items (in line with the relevant risk profiles and Yinson’s overall risk appetite), monitoring and escalating/ reporting to the relevant parties within Yinson (in accordance with the tax risk escalation matrix, that has been mapped to Yinson’s wider risk management framework).

This is complemented by regular updates from external tax advisors, discussions/ dialogues with the professional bodies and Tax authorities, as well as participation in relevant seminars/ conferences. All relevant information and tax updates will be shared with the management and other related departments in a timely manner.

Whilst we aim to ensure that our tax positions are in line with the requirements of the tax laws and regulations, there may be instances where it may differ from the tax treatment prescribed by the Tax authorities. Where such circumstances arise, Yinson will work constructively with the Tax authorities to achieve a resolution for these tax matters.

Depending on the degree/ level of tax risk and the nature of the transactions involved, we will refer to the Board of Directors and the Board Audit Committee for approval and guidance on the decisions/ steps to be taken. Where required, we will obtain written advice from external tax and legal advisors on high-risk transactions or areas of uncertainty regarding the interpretation of the tax law, to support our decision-making process.

We seek to manage our tax affairs in a manner that is consistent with our tax strategy principles, alongside our team of qualified and trained tax professionals.

Yinson seeks to:

- Deal and communicate with the Tax authorities and other relevant agencies in a collaborative, courteous and timely manner.

- Engage with the Tax authorities to discuss the application/ interpretation of relevant tax laws and regulations.

- Make fair, accurate and timely disclosure in correspondences, returns and any other relevant matters.

- Address/ respond to queries and information requests on a timely basis, amicably resolve issues with the Tax authorities in relation to any disputed matters and request for a ruling/ confirmation on technical positions, where applicable and possible. Where we are of the view that our legitimate rights have been impeded, we will take the appropriate and necessary steps to safeguard the interest of the organisation.